We’re nearing the end of 2017, and, for me, that means the third annual iteration of our Patent Expiration piece in the world of pharmaceuticals. If this ongoing series has taught me anything, it’s that people of the world are constantly looking to the promise of the future.

No matter how difficult today may be, tomorrow, at least in thought, always has the potential to bring a fresh start. With each fresh start is an opportunity to make something better. To paraphrase little orphan Annie, the sun will always come out tomorrow.

For some, that means a new dawn on a new day. For others it could mean the promise of many more dawns in a future that was previously in question.For some cancer patients and those who have health concerns related to HIV, for example, it could very well mean the availability of generic drugs and, thus, access to more affordable modern healthcare. Before we get to that, though, let’s review what we’ve already learned about pharmaceutical patents.

First, and most importantly, we are not experts on patent law. What we’ll share here, and what we’ve shared in the past, is based on research we’ve conducted and not based on real life experience as patent attorneys. If you’d like any additional information on patents visit FDA for more in depth details and answers to a number of FAQ’s on the topic. Beyond that, here’s what we’ve found in our research.

According to an article by news-medical.net, when a drug is under patent protection, only the company that holds the patent is allowed to manufacture, market the drug and eventually make profit from it. Because patents are often applied long before a drug reaches the market, most drugs only end up being protected for between seven to twelve years once it finally goes on sale.

The process from patent request to sale is a long, and often arduous, process. So much so that only 5% of medications ever reach the market. You can read more in depth about this process on our blog.

When patents expire, manufacturers wanting to sell a now generic version of a drug have much fewer hoops to jump through to reach the market. As we discussed last year, manufacturers desiring to sell the now-generic version of a drug that has gone off-patent do not need to prove the safety and efficacy of the drug since that has already been done. All they must do is prove their proposed generic is the same as the previously approved name brand version.

While it is commonly believed that the FDA’s drug approval process is slower than its foreign competitors, it is often faster and more willing to approve certain drugs. Seventy-five percent of the new drugs approved by both the FDA and European Medicines Agency (EMA) between 2006 and 2010 were first approved in the United States, while the FDA approved 32 of 35 prospective cancer drugs from 2003-2010. The EMA approved only 26. You can read more about the overall investment that pharmaceutical companies typically spend to develop patents in our first patent blog from 2015.

All of this boils down to an important point for consumers. Those who are most in need of these often life saving drugs (Remember the cancer patients and those who are HIV positive we mentioned earlier?) have a lot to save. Studies dating back to 2008 suggested there was often a saving of more than 70% on generics when compared to their brand named counterparts. However, more recent research by FDA suggests that generic drugs often cost more than 80% less than their name-brand counterparts.

For those who are HIV positive, this could mean access to drugs that were previously unavailable. The LGBT community is often at higher risk for the disease, and is 30% more likely to fall below the poverty line, and as much as 60% more likely to be uninsured. While saving 85% over the cost of name brand drugs won’t get it into the hands of every one of these patients, it does make it more available for those who struggle to pay the premiums on drugs that are still working to recoup dollars spent during their development.

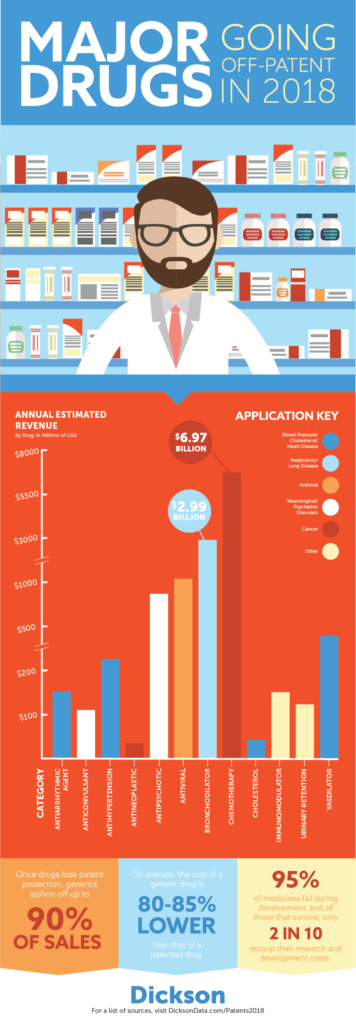

In total, $16.5 billion is on the table for those looking to market generic pharmaceuticals. That number accounted for more than 3.5% of the industry’s total earnings in 2016 according to Statista. While the pharma industry will be forced to navigate their newest round of patent expirations to make up for lost revenue, patients with generics on the horizon will rejoice the coming year. Regardless of what may ultimately come in 2018, for those in need, the future sure looks bright.